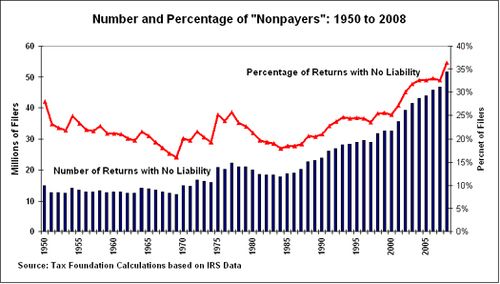

I remember the President saying, “Everybody is going to have to give. Everybody is going to have to have some skin in the game.” But, we all knew that he didn’t mean everybody. Take a guess whom those who pay nothing are picking at the polls.

More reason for a flat tax, or at least, an everybody pays something tax. Good idea, Mr. President.

Why does everyone forget sales tax?

Everyone who buys anything pays that in states that have sales tax.

Or the fact that those on the “poor” side of the scale have less expendable income that can go from bills and food towards more taxes? Our household income is $10,000 or less every year, and we still pay taxes and pay a very high percentage on sales tax (9.75%, 10% rounded on purchases under a certain price). And we STILL get nearly 20% of each paycheck out.

Sales tax goes to the state, unless I’m wrong. Doesn’t do anything to the people that cheat off the federal taxes.

Ishida:

Ted is right. Sales tax only benefits each state. Those that pay no Federal Income Tax will ALWAYS vote for the expansion of the Federal Government, because it does not hurt them in the pocket book.

I will disagree that “Those that pay no Federal Income Tax will ALWAYS vote for the expansion of the Federal Government, because it does not hurt them in the pocket book. ”

I have not had to pay anything additional on my federal taxes yet (barely) because the government ALREADY takes about 40% of my salary before I get to do anything with it. If you want real change to occur, give everyone their FULL paycheck, then have them write a check April 15. Once Joe Citizen really realizes that he is not getting money *BACK* from the government but is instead *PAYING* a massive amount of money, THEN it will hit home. Ask anyone who has to fill out their 1099s every year.

T

Given the lack of fiscal responsibility that is now in vogue, you’d probably more than quadruple the number of tax arrests, since dollars to donuts a huge portion of the populace would not have enough money saved to pay the tax bill come April.